Market Movers Last week, 282 originators switched companies and 943 individuals obtained their NMLS...

Mortgage Market Intel #7 - Feb 16, 2026

Market Movers

Last week, 429 originators switched companies and 1,187individuals obtained their NMLS license. Notable originator movements lastweek include:

- Tayler Fick ($121.7M,379 units) joined Atlantic Coast Mortgage, LLC from Lower, LLC

- John Morrison($114.8M, 345 units) joined Rocket Mortgage, LLC from Nationstar MortgageLLC

- Kelsey Marquardt($111.1M, 260 units) joined Guaranteed Rate, Inc. from Universal LendingCorporation

- Christopher Noble($110.6M, 231 units) joined HomeAmerican Mortgage Corporation from CLMMortgage, Inc

- Robert Simmons($101.2M, 252 units) joined Rocket Mortgage, LLC from Nationstar MortgageLLC

- Donald Pierce($97.4M, 286 units) joined Rocket Mortgage, LLC from Nationstar MortgageLLC

- Jason Knee ($93.1M,130 units) joined First National Bank of Pennsylvania from TD BankNA

- Sosimo Avila ($83.7M,98 units) joined Mamba Capital Lending Inc. from WestCapital Lending, Inc.

- Sofia Retra ($81.1M,238 units) joined Rocket Mortgage, LLC from Nationstar MortgageLLC

- Joseph Gulino($79.4M, 197 units) joined Lendwise Mortgage, Inc. from PFN Lending Group,Inc.

- Samantha Martin($75.2M, 217 units) joined Rocket Mortgage, LLC from Nationstar MortgageLLC

- Kimberly Liu ($69.1M,130 units) joined HomeAmerican Mortgage Corporation

- Kristian Kirkevold($68.6M, 146 units) joined HomeAmerican Mortgage Corporation

- Skylar Welch ($65.5M,148 units) joined Fusion Home Loans, LLC from Madison MortgageServices Inc.

Figures are based on last 14 months’ production.

Market Movers (Companies)

Top Gainers (non-Bank/CU):

- Atlantic Coast Mortgage, LLC+19.68%

- HomeAmerican Mortgage Corporation+8.74%

- Efinity Financial, LLC +8.67%

- Member First Mortgage, LLC+7.68%

- American Financial Network, Inc. +5.24%

- Lending Heights, LLC+5.09%

- Cornerstone First Mortgage, LLC +5.02%

- Gold Star Mortgage Financial Group, Corporation +4.29%

- Adaxa, LLC+4.08%

- Ethos Lending, Inc. +3.92%

- Green Lending LLC+3.73%

- Loan Pronto, Inc. +3.67%

Calculations based on last aggregate production of individual LO’s 14 months’ production for companies with at least 20 loan officers. Excludes companies below $100M in 14mo LO production value after gains factored in.

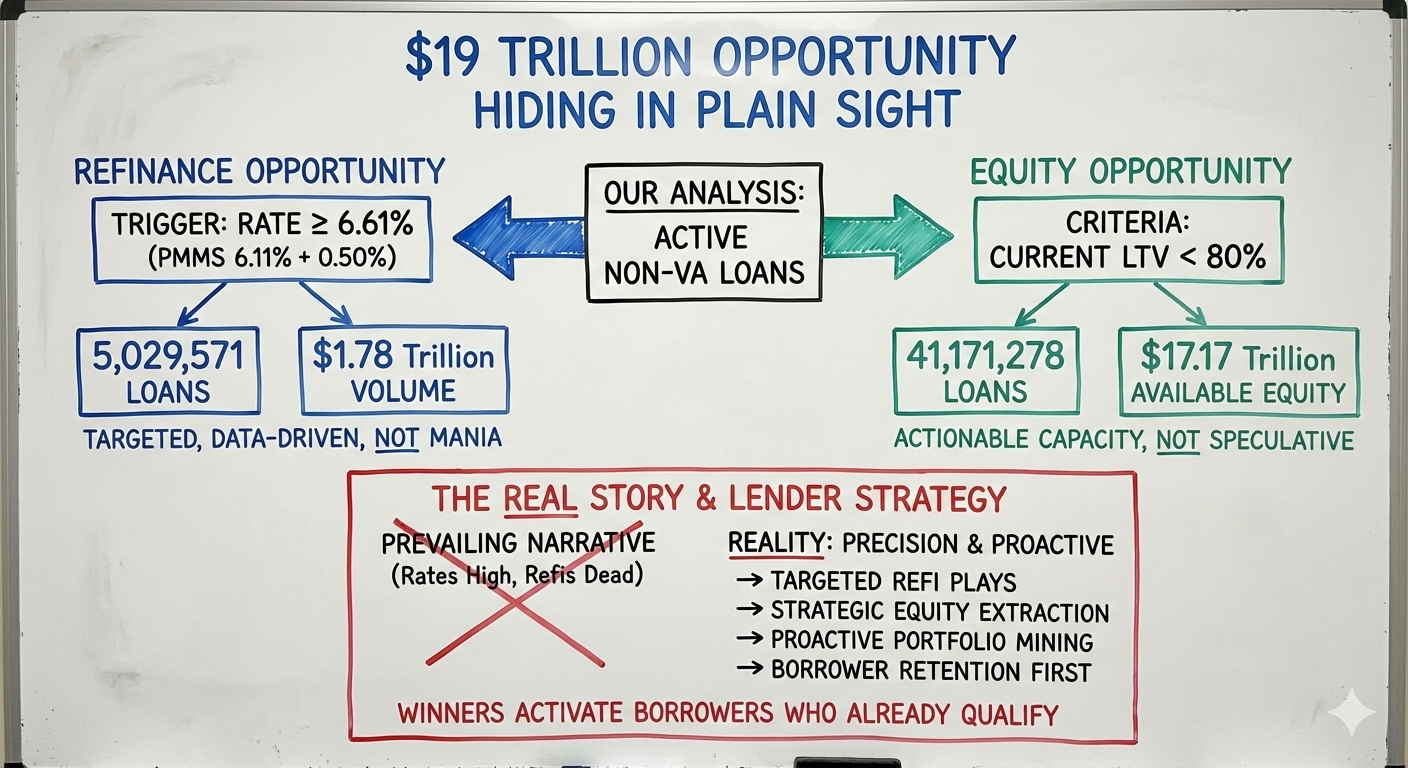

The $19 Trillion Opportunity Hiding in Plain Sight

In our last article, we highlighted the MI removalopportunity inside servicing portfolios.

This time, we zoomed out.

We analyzed active non-VA loans across our database tomeasure two things:

- Refinance opportunity

- Available equity opportunity

What we found should reframe the industry narrative.

Refinance Opportunity

Using the most recent Primary Mortgage Market Survey (PMMS)rate of 6.11%, we set our refinance trigger threshold at PMMS + 0.50% (6.61%).

Why?

Because meaningful refinance opportunity is not just"lower than today’s rate." It requires margin - room to justifytransaction costs and borrower benefit.

We identified all non-VA loans with rates ≥ 6.61%.

The result:

- 5,029,571 loans

- $1,783,738,125,023 in potential refinance volume

Methodology:

Refi Opportunity (Volume) = Sum of home values for non-VA loans where interestrate ≥ 6.61% × 80%

Refi Opportunity (Units) = Count of non-VA loans where rate ≥ 6.61%

Even in a higher-rate environment, nearly $1.8 trillion inrefinance-eligible collateral exists today using a conservative threshold.

This is not 2020-style refi mania.

It is targeted, data-driven opportunity.

Equity Opportunity

Next, we measured tappable equity.

We analyzed non-VA loans with current LTVs below 80% andcalculated available equity up to the 80% LTV threshold.

Here is what surfaced:

- 41,171,278 loans

- $17,175,996,544,186 in available equity

Methodology:

Equity Opportunity (Volume) = (Sum of AVMs × 80%) − (Sum of current loanbalances)

Equity Opportunity (Units) = Count of non-VA loans where current LTV < 80%

That is over $17 trillion in accessible equity withinconservative lending standards.

Not speculative value.

Actionable borrowing capacity.

The Real Story

The prevailing narrative says:

- Rates are too high

- Refis are dead

- There is no volume

But the data tells a different story.

There are:

- 5 million refinance candidates

- 41 million equity candidates

- Nearly $19 trillion in combined opportunity

The opportunity is not gone.

It is unevenly distributed - and increasingly dependent onprecision.

What This Means for Lenders

The next mortgage cycle will not be driven by broad ratedrops alone.

It will be driven by:

- Targeted refinance plays

- Strategic equity extraction

- Proactive portfolio mining

- Borrower retention before competitors engage

The winners will not wait for rates to fall.

They will activate the borrowers who already qualify.

Upcoming RETR Training

- Wed, Feb 18 @ 12p ET - How to Win Realtor Relationships with RETR Register

Stop guessingand start building relationships with context. In this class, you’ll learn howtop-producing loan officers use RETR to identify the right agents, engage atthe right moment, and build relationships that compound. - Thurs, Feb 19 @ 2p ET - Intro to RETR: The Modern Loan Officer’s DataAdvantage Register

An overview ofthe many tools available to you in RETR – from agent and LO research, to listbuilding and bulk contact exports, and borrower retention and refi findertools, and more!

Is RETR Better?

When it comes to mortgage market intelligence, you have ahandful of options, and RETR is one that truly stands out. Here’s what Dino Katsiametis, Founder & CEO of Ethos Lending has to say about RETR: “RETR has completely streamlined how we track loan officer and realtor production. It delivers real-time insights that used to take hours to gather and turns data into actionable growth opportunities. If you’re in mortgage or real estate and want a smarter way to manage performance, RETR is the tool to beat.”

But you don’t have to take their word for it. RETR offers a free trial to loan officers, branches, and mortgage companies to judge the quality of the data and insights for themselves.