Borrower Retention Winners and Losers Last week, we shared a stat that raised a few eyebrows: Top...

Mortgage Market Intel #5 - Feb 2, 2026

Market MoversLast week, 282 originators switched companies and 943 individuals obtained their NMLS license. Notable originator movements last week include:

Figures are based on last 14 months’ production. |

Market Movers (Companies)Top Gainers (non-Bank/CU):

Calculations based on last aggregate production of individual LO’s 14 months’ production for companies with at least 20 loan officers. |

|

What DISC Reveals About Today’s Loan Officer Part 1: Establishing the Industry Baseline

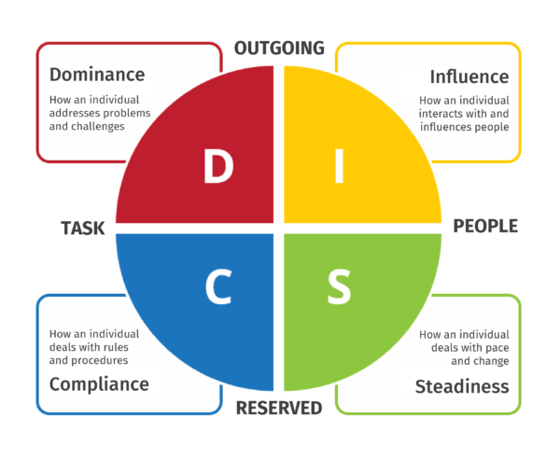

Mortgage is often described as a relationship-driven sales business. In DISC terms, that usually translates to a simple assumption: loan officers are high-I personalities—outgoing, persuasive, and people-first.

The data tells a more nuanced story.

Using DISC analysis across a broad population of loan officers, we set out to answer a basic question before drawing any performance conclusions: What does the average loan officer actually look like from a behavioral standpoint?

Not who performs best. Not who moves companies. Just the baseline. |

|

|

The Dataset This analysis includes tens of thousands of loan officers observed across the industry, spanning multiple production levels and business models. DISC scores were evaluated alongside production characteristics to ensure the population reflects current market realities.

DISC is not a measure of skill or success. It’s a behavioral framework that helps explain how people tend to communicate, make decisions, respond to change, and operate under pressure.

At scale, those tendencies become patterns.

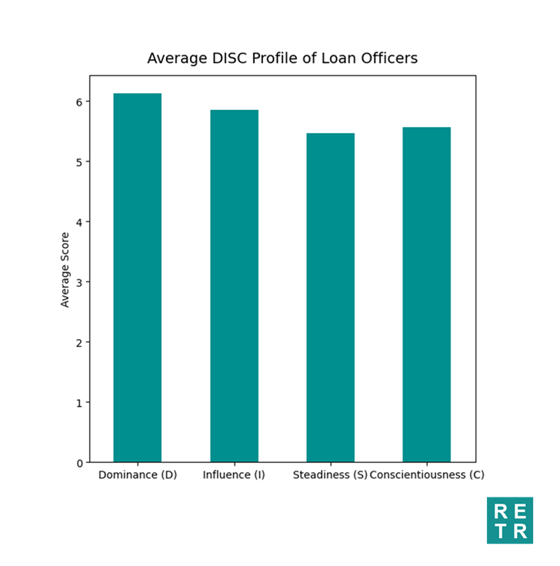

The Average Loan Officer DISC Profile

When you aggregate the data, one thing becomes clear quickly: the industry does not skew toward extreme personalities.

Average DISC scores cluster tightly across all four dimensions:

Rather than being defined by one dominant trait, the “average” loan officer exhibits a balanced behavioral profile.

In practical terms, this suggests that most loan officers:

This balance aligns closely with the realities of mortgage lending, which sits at the intersection of sales, service, and operations. |

|

|

What Stood Out

A few observations emerged immediately from the baseline data:

First, high-D profiles are less prevalent than many leaders expect.

Second, S and C traits show up more consistently than the industry’s reputation suggests.

Third, the industry looks behaviorally balanced, not polarized.

That balance may help explain several common friction points across the industry, from uneven technology adoption to challenges with rapid organizational change. When a population values consistency and process, constant disruption carries a cost.

What This Baseline Is - and Isn’t

This analysis does not tell us which DISC profiles perform best. It doesn’t rank personalities or predict success.

What it does is establish a clear starting point: who shows up in mortgage today, behaviorally speaking.

Understanding that baseline matters. Leadership expectations, recruiting strategies, coaching styles, and change initiatives all tend to assume a certain personality profile. When that assumption is off, misalignment follows.

What Comes Next

In a future article, we’d like to segment this same DISC data by performance quartile, comparing upper-quartile producers, mid-range performers, and the lower quartile to see where meaningful differences emerge-and where they don’t. Beyond that, we’d like your input.

Should future analysis focus on:

DISC data becomes more powerful as the questions get sharper. Let us know what you’d like to explore next.

|

Upcoming RETR Training

|

Recent RETR Features

|

Is RETR Better?

When it comes to mortgage market intelligence, you have a handful of options, and RETR is one that truly stands out. Here’s what Jordan Nutter, a top producer from NFM Lending has to say about RETR: “I use RETR as a research tool to better understand an agent’s business before connecting with them. It helps me tailor my conversations, add value faster, and position myself as a strategic partner rather than just another lender.”

|

|

|

But you don’t have to take their word for it. RETR offers a free trial to loan officers, branches, and mortgage companies to judge the quality of the data and insights for themselves. |