Where (and when) have all the LO’s Gone? In 2024 the industry lost 20,000 loan officers. That was...

Mortgage Market Intel #3 - Jan 19, 2026

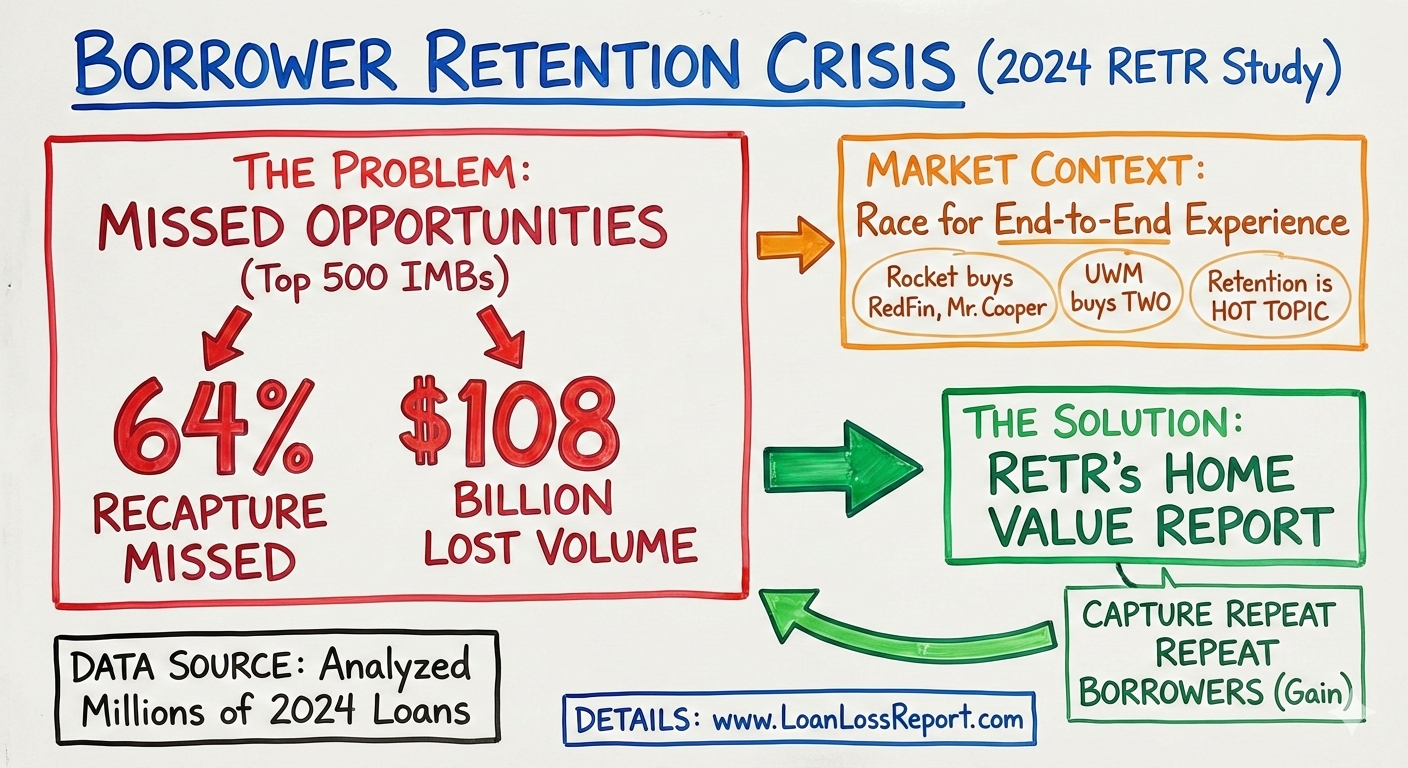

Mortgage Companies Miss 64% of Repeat Borrower Opportunities

After analyzing millions of loans from 2024, RETR discovered that top IMBs are missing out on over 64% of opportunities to capture repeat borrowers. The study distinctly identified over $108 billion in lost borrower recapture opportunities among the Top 500 IMBs. Study research and results are available to view on a per-company and per-originator basis at www.LoanLossReport.com.

Borrower retention has become a hot topic this year as companies race to own the end-to-end consumer experience in real estate and mortgage, as highlighted with Rocket’s acquisition of RedFin and Mr. Cooper, and also UWM’s acquisition of Two Harbors. One solution that originators turn to for borrower retention is RETR’s Home Value Report. Also see link in Training section for Borrower Retention strategy class.

Market Movers

Last week, 411 originators switched companies and 1,318 individuals obtained their NMLS license.

Notable originator movements last week include:

- Samantha Phucas ($121.7M, 357 units) joined All Western Mortgage, Inc. from Lennar Mortgage, LLC

- Tasha Faiella ($93.6M, 305 units) joined CrossCountry Mortgage, LLC from Cardinal Financial Company, Limited Partnership

- Lauren Aschenbrenner ($80.4M, 226 units) joined Lakeview Loan Servicing, LLC from Pulte Mortgage LLC

- Jeremy King ($71.7M, 191 units) joined King Mortgage Group LLC from CASTLE ROCK CAPITAL FUNDING LLC

- Steven Grodzinski ($70.3M, 143 units) joined Cornerstone First Mortgage, LLC from The Newfinity Group INC.

- John Kameen ($61.6M, 137 units) joined Evolution Mortgage LLC from UMortgage LLC

- Stephen Oliver ($60M, 214 units) joined Guild Mortgage Company LLC from Mortgage Solutions of Colorado, LLC

- Thomas Dibiase ($57.5M, 121 units) joined Professional Mortgage Advisors, LLC from Oakleigh Mortgage Advisors LLC

- Breon Price ($57.3M, 179 units) joined Union Home Mortgage Corp. from OPUS HOME LOANS INC

- Drew Jaeger ($52.8M, 163 units) joined OverDrive Mortgage LLC from T Y Mortgage, LLC

Figures are based on last 14 months’ production.

Market Movers (by Producer Volume)

Top Gainers (non-Bank/CU):

- Altamont Funding, Inc. +93.69%

- EXPERT MORTGAGE LENDING, LLC +34.19%

- DTJS Financial Services, Inc. +20.29%

- Aspire Mortgage Advisors LLC +16.79%

- Beeline Loans, Inc. +15.4%

- Affordable Mortgage Advisors, LLC +11.76%

- Eureka Mortgage Planning LLC +10.47%

- One Real Mortgage Corp. +9.76%

- Home Mortgage Advisors, LLC +9.18%

- Federal First Lending LLC +8.42%

Calculations based on last aggregate production of individual LO’s 14 months’ production.

Recent RETR Features

- Add more options to the Loan Purpose filter in the Refi Finder pages

- Add LMI/MMCT percentages filtering to mortgage company and branch searches

- Add filter for Conv%, VA %, FHA % in the LO rankings page

- Coming Soon: API

Upcoming RETR Training

- Mon, Jan 19 @ 2p ET - Intro to RETR: The Modern Loan Officer’s Data Advantage Register

An interactive overview of the RETR tools top loan officers and branch managers use to find agents, strengthen relationships, and uncover new opportunities using data. - Wed, Jan 21@ 12p ET – The Borrower Retention Advantage: How Loan Officers Stay Relevant Long After the Close Register

Learn how RETR helps you turn past clients into future opportunities through smart alerts and data-driven follow-up. - Thurs, Jan 22 @ 2p ET - Intro to RETR: The Modern Loan Officer’s Data Advantage Register

An overview of the many tools available to you in RETR – from agent and LO research, to list building and bulk contact exports, and borrower retention and refi finder tools, and more!

Is RETR Better for Mortgage Market Intelligence?

When it comes to mortgage market intelligence, you have a handful of options, and RETR is one that truly stands out. Here’s what David Starling, a top producer from Highland Mortgage with over $27M in volume in the past year, has to say about RETR: “RETR is the best! It helps me track refi opportunities, find top real estate agents, and monitor my referral partners all in one place. I love using the New Listings tab to connect with agents and offer help to market their listings. That’s just the beginning—RETR has so many tools to grow your business. If you’re not using RETR, you are losing out, not to mention, working much harder than you need to!”

But you don’t have to take their word for it. RETR offers a free trial to individuals and organizations to judge the quality of the data and insights for themselves.