Borrower Retention Winners and Losers Last week, we shared a stat that raised a few eyebrows: Top...

Mortgage Market Intel #6 - Feb 9, 2026

Market Movers

Last week, 307 originators switched companies and 1,157 individuals obtained their NMLS license. Notable originator movements last week include:

- Nicole Rueth ($156.6M, 317 units) joined CrossCountry Mortgage, LLC from Movement Mortgage, LLC

- Jared Robbins ($128.6M, 470 units) joined MortgageOne, Inc. from Guild Mortgage Company LLC

- Bernadette Sisneros ($113.5M, 358 units) joined Guaranteed Rate, Inc. from loanDepot.com, LLC

- Austin Lusk ($94.2M, 310 units) joined Nationwide Mortgage Bankers, Inc. from Lennar Mortgage, LLC

- Jordan Dawson ($69M, 245 units) joined MortgageOne, Inc. from Guild Mortgage Company LLC

- Stephen Oliver ($60.9M, 216 units) joined MortgageOne, Inc. from Guild Mortgage Company LLC

- Patrick Lasher ($49.6M, 39 units) joined TD Bank NA from Citizens Bank, National Association

- Michael Bernhart ($47.2M, 230 units) joined Cornerstone First Mortgage, LLC from Synergy One Lending, Inc.

- Paul Carini ($47M, 153 units) joined Loan Pronto, Inc. from Primary Residential Mortgage, Inc.

- Jason Heyroth ($44.7M, 105 units) joined Guaranteed Rate, Inc. from U.S. Bank National Association

Figures are based on last 14 months’ production.

Market Movers (Companies)

Top Gainers (non-Bank/CU):

- MortgageOne, Inc. +48.72%

- Victorian Finance, LLC +7.73%

- Absolute Home Mortgage Corporation +7.68%

- Loan Pronto, Inc. +7.47%

- Federal First Lending LLC +7.31%

- Advantage Lending, LLC +7.25%

- LendingHouse NA, LLC +4.6%

- Nationwide Mortgage Bankers, Inc. +4.5%

- MY COMMUNITY MORTGAGE LLC +3.29%

- New Era Lending LLC +3.04%

Calculations based on last aggregate production of individual LO’s 14 months’ production for companies with at least 20 loan officers. Excludes companies below $100M in 14mo LO production value after gains factored in.

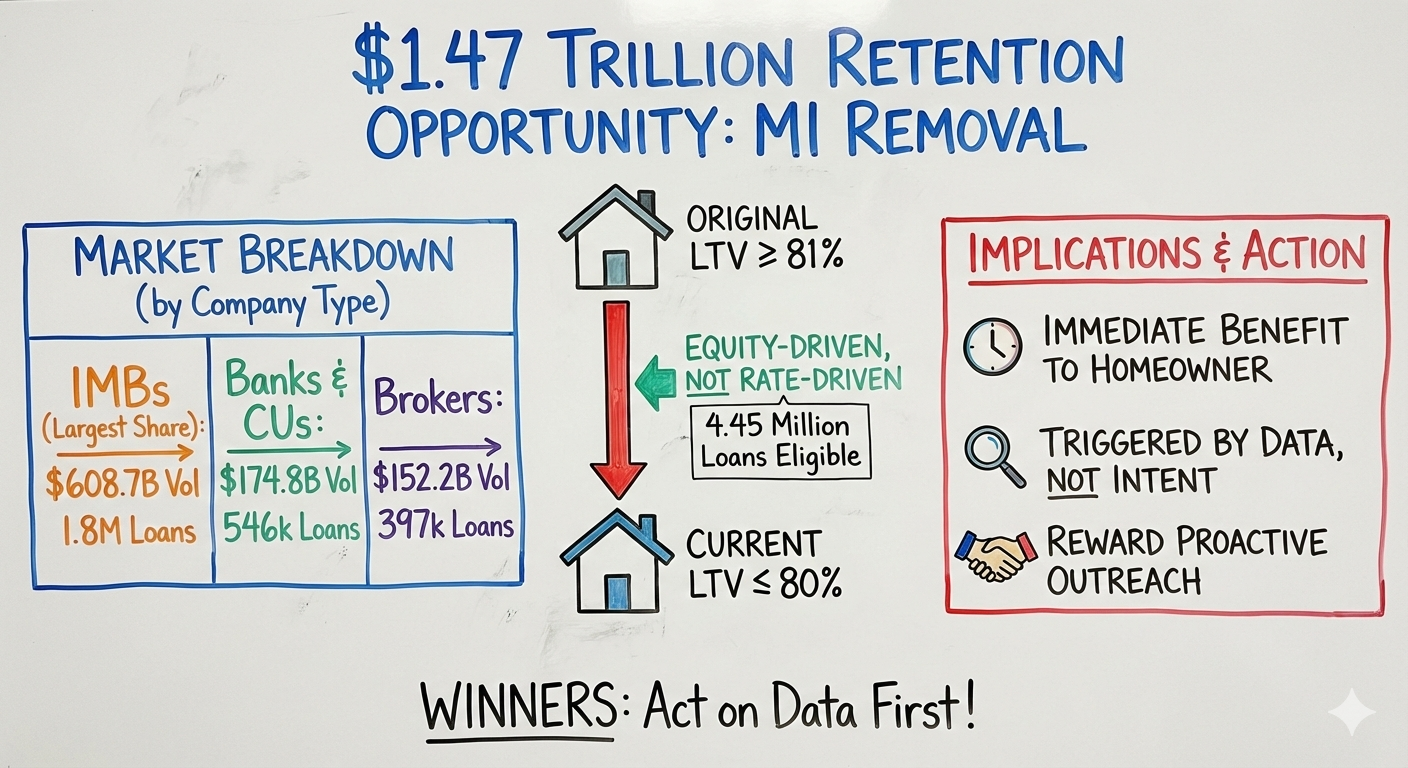

A $1.47 Trillion Retention Opportunity-And Who’s Holding It

In borrower retention conversations, the spotlight usually falls on rates, refis, and repeat purchase behavior. But our latest analysis shows one of the largest retention opportunities in the market has nothing to do with a new loan at all.

It’s mortgage insurance removal.

Across active non-VA loans, we identified $1.47 trillion in potential MI removal volume, representing 4.45 million loans where:

- The original LTV was 81% or higher, and

- The current LTV has fallen to 80% or below.

For these loans, we calculated potential MI-removal volume using current home values multiplied by 80%. In practical terms, this represents millions of borrowers who may be eligible to drop MI today-often without realizing it.

When we break that opportunity down by company type, the differences are hard to ignore.

Independent Mortgage Banks (IMBs) hold the largest share by a wide margin, with:

- $608.7 billion in MI removal volume

- 1.8 million eligible loans

Banks and credit unions account for:

- $174.8 billion in volume

- 546,000 loans

Brokers, despite originating fewer loans overall, still represent:

- $152.2 billion in volume

- 397,000 loans

The scale alone is notable-but the implications are more interesting.

In our prior borrower retention research, we showed that retention performance varies dramatically across these same lender groups. Banks and credit unions tend to retain borrowers at far higher rates, while IMBs and brokers often struggle to recapture even a modest share of repeat opportunities.

MI removal adds a new dimension to that discussion.

These are borrower conversations that are:

- Equity-driven, not rate-driven

- Immediately beneficial to the homeowner

- Triggered by data, not borrower intent

In other words, they reward lenders who are proactive rather than reactive.

For IMBs especially, the data suggests a massive but fragile opportunity. Holding the largest pool of MI-eligible borrowers also means having the most to lose if those homeowners learn about MI removal from a third party-or associate the savings with someone else.

For banks and credit unions, the opportunity may be smaller in absolute terms, but it aligns closely with their historical strength: using servicing visibility to initiate timely, trust-building outreach.

And for brokers, MI removal highlights an often-overlooked reality. Even without servicing the loan, a significant number of past clients may already be eligible for meaningful payment relief-creating a rare reason to re-engage without pitching a refinance.

At $1.47 trillion, MI removal isn’t a niche servicing task. It’s one of the largest untapped borrower engagement opportunities in the market. And just like borrower retention itself, the winners won’t be determined by who has the data-but by who knows how to act on it first.

Upcoming RETR Training

- Mon, Feb 9 @ 2p ET - Intro to RETR: The Modern Loan Officer’s Data Advantage Register

An overview of the many tools available to you in RETR – from agent and LO research, to list building and bulk contact exports, and borrower retention and refi finder tools, and more! - Wed, Feb 11 @ 12p ET - The New Refi Playbook: How to Find (and Win) High-Intent Refinance Opportunities Register

Rates don’t create refinance opportunities-data does. Learn how to surface equity, PMI removal, and payment-saving refis before anyone else sees them. - Thurs, Feb 12 @ 2p ET - Intro to RETR: The Modern Loan Officer’s Data Advantage Register

An overview of the many tools available to you in RETR – from agent and LO research, to list building and bulk contact exports, and borrower retention and refi finder tools, and more!

Recent RETR Features

- Home Value Report enhancements

- Major infrastructure upgrades

- API Beta: Initial rollout + enhancements to enterprise customers

Is RETR Better?

When it comes to mortgage market intelligence, you have a handful of options, and RETR is one that truly stands out. Here’s what top-producer Evan Einhorn from Modern Home Lending, has to say about RETR: “RETR is a powerful tool for loan officers and brokers. It goes beyond just showing production data but gives insight into LO and Agent’s own business and prospective partners, too. RETR dives deeper into what investors LO’s favor, areas they work in, along with giving them opportunity information like Refi Finder and Loan Loss Report which is valuable info.”

But you don’t have to take their word for it. RETR offers a free trial to loan officers, branches, and mortgage companies to judge the quality of the data and insights for themselves.